- What is Amazon CEE?

- What are the advantages of the CEE program?

- What are the disadvantages of the CEE program?

- When is the Central Europe program the right storage program for me?

- Tax and Reporting Obligations for the CEE program

- What are the fees for the CEE program?

- How do I sign up for the CEE program?

- Conclusion

Amazon Sellers using the Fulfillment by Amazon (FBA) program have the option to delegate their logistics and shipping processes entirely to Amazon. Within the FBA program, Amazon offers various storage programs in Seller Central, each differing in the countries where goods are stored.

This article introduces you to the "Central European Program" (CEE) storage program. Amazon Sellers who utilize the CEE program store their goods not only in German logistics centers but also in logistics centers in Poland and the Czech Republic.

What is Amazon CEE?

Amazon Sellers using the Central European Program store their goods in Amazon's logistics centers in Germany, Poland, and the Czech Republic. All orders are shipped from these warehouses to all other European countries. With the CEE program, you can sell on all European marketplaces, even though your goods are stored only in Germany, Poland, and the Czech Republic.

Amazon promotes this storage model because logistics centers in Poland and the Czech Republic can operate at significantly lower costs than other Amazon locations. Unlike the Amazon EFN program, the CEE program does not incur a penalty fee of 0.25 Euros per unit sold. However, an essential factor to consider with the CEE program is that you are selling products from abroad to other countries by storing goods in Poland and the Czech Republic. This means you will have to remit value-added tax (VAT) in those countries and be aware of additional tax-related consequences. It is crucial to inform yourself about the tax implications before registering for the program.

With the CEE program, you ship all your goods to German logistics centers. Amazon then manages the distribution to logistics centers in Germany, Poland, and the Czech Republic. The specific logistics center you need to deliver to depends on your transport partner. You can find all destination addresses on this page in Seller Central. Once Amazon receives your shipment, it will be forwarded to one of the logistics centers in Poland or the Czech Republic. Please note that there may be up to a 12-hour delay between the delivery confirmation from your transport service and Amazon's acknowledgment of receipt. In Seller Central, under "Reports," click on "Fulfillment by Amazon." There, you will find various reports related to Amazon FBA. To verify if all shipped units have arrived, you can download the Inventory Event Detail Report. This report provides an overview of all inventory, inbound, correction, and payment reconciliation events.

By participating in the CEE program, you still have access to all Amazon services, such as the prep service or labeling service.

What are the advantages of the CEE program?

We've summarized the four most important advantages for you:

- No penalty fee of 0.25 Euros per shipped unit: Unlike the EFN program, the CEE program does not incur penalty fees when selling across Europe. This results in lower shipping fees for you.

- You only deliver to German logistics centers: Despite storing your goods in Poland, the Czech Republic, and Germany, you only need to provide to German logistics centers. Amazon will then independently distribute the goods to the logistics centers.

- All shipping and export functions are available to you: Even though you store your goods in only three countries, you can deliver to customers worldwide. This means that a customer from Italy can also order an item from you in Germany.

- You benefit from lower remission costs: Although the return of your items from abroad (Poland and the Czech Republic) is handled under the CEE program, Amazon treats and charges returns as local returns.

Example of monthly fee savings:

| Monthly units sold | Monthly savings |

|---|---|

| 1000 | 250 |

| 5000 | 1250 |

| 25000 | 6250 |

What are the disadvantages of the CEE program?

Before choosing the CEE program, you should also be aware of the disadvantages of the shipping program:

- You must consider the tax consequences: Selling goods from abroad makes you subject to value-added tax (VAT) obligations in Poland and the Czech Republic. You'll need to register for VAT locally.

- Shipping abroad is associated with longer delivery times (from the customer's perspective): Unlike the Pan-EU program, you won't benefit from fast international shipping since the shipping routes won't be shorter.

When is the Central Europe program the right storage program for me?

From the advantages and disadvantages, it can be concluded that the CEE program is ideal for medium-sized or growing businesses. You should consider the CEE or Pan-EU program if you sell more than 1,000 units per month. Beyond this threshold, the additional tax costs typically outweigh the savings from the eliminated penalty payments.

Tax and Reporting Obligations for the CEE program

When you choose the "Central Europe" program, you will be required to register for value-added tax (VAT) in Poland and the Czech Republic. It's important to note that VAT registration must be completed before you enroll in the program. Since you are shipping products from Poland and the Czech Republic, the applicable VAT depends on various factors, such as whether you are selling locally or cross-border and whether you are selling to a business customer or an end consumer.

Firstly, you must declare an intra-community transfer to Poland and the Czech Republic, informing these countries that goods are stored there. In the recipient country, the storage of goods constitutes an intra-community acquisition. You must provide all details of the goods movement (when exactly which goods were transferred and in what quantity) in the Summary Statement. If you have a local VAT identification number, the intra-community transfer is tax-exempt.

Additionally, for sales to end consumers (B2C deliveries) in the EU, sales are generally subject to taxation in the destination country. For delivery from Poland to Germany, for example, German VAT applies. We recommend that you consult with a tax advisor to avoid errors and associated severe consequences.

What are the fees for the CEE program?

The storage fees are calculated independently of the storage program and vary depending on the storage location, product type, size, and weight of the product. Your inventory is considered as "German inventory" and distributed to various logistics centers in the three countries, similar to the Amazon EFN program.

The shipping fees also depend on the dimensions and weight of the sold item. Here, we provide an example of shipping costs for a standard envelope with dimensions of 33 x 23 x 4 cm and a weight under 60 g. You can find all the additional shipping costs here →.

| Storage country | Destination country | Shipping costs |

|---|---|---|

| DE/PL/CZ | Germany | €1.29 |

| DE/PL/CZ | United Kingdom | £4.69 |

| DE/PL/CZ | Italy | €5.00 |

| DE/PL/CZ | France | €5.83 |

| DE/PL/CZ | Spain | €5.64 |

| DE/PL/CZ | Other EU country | €7.02 |

Compared to the Pan-EU program, you pay relatively higher shipping fees with the CEE program. Sellers using the Pan-EU program store their products in multiple EU countries, resulting in domestic shipping. In our example, the shipping costs for an order to France would be €5.03, and to Spain, it would be €4.77.

How do I sign up for the CEE program?

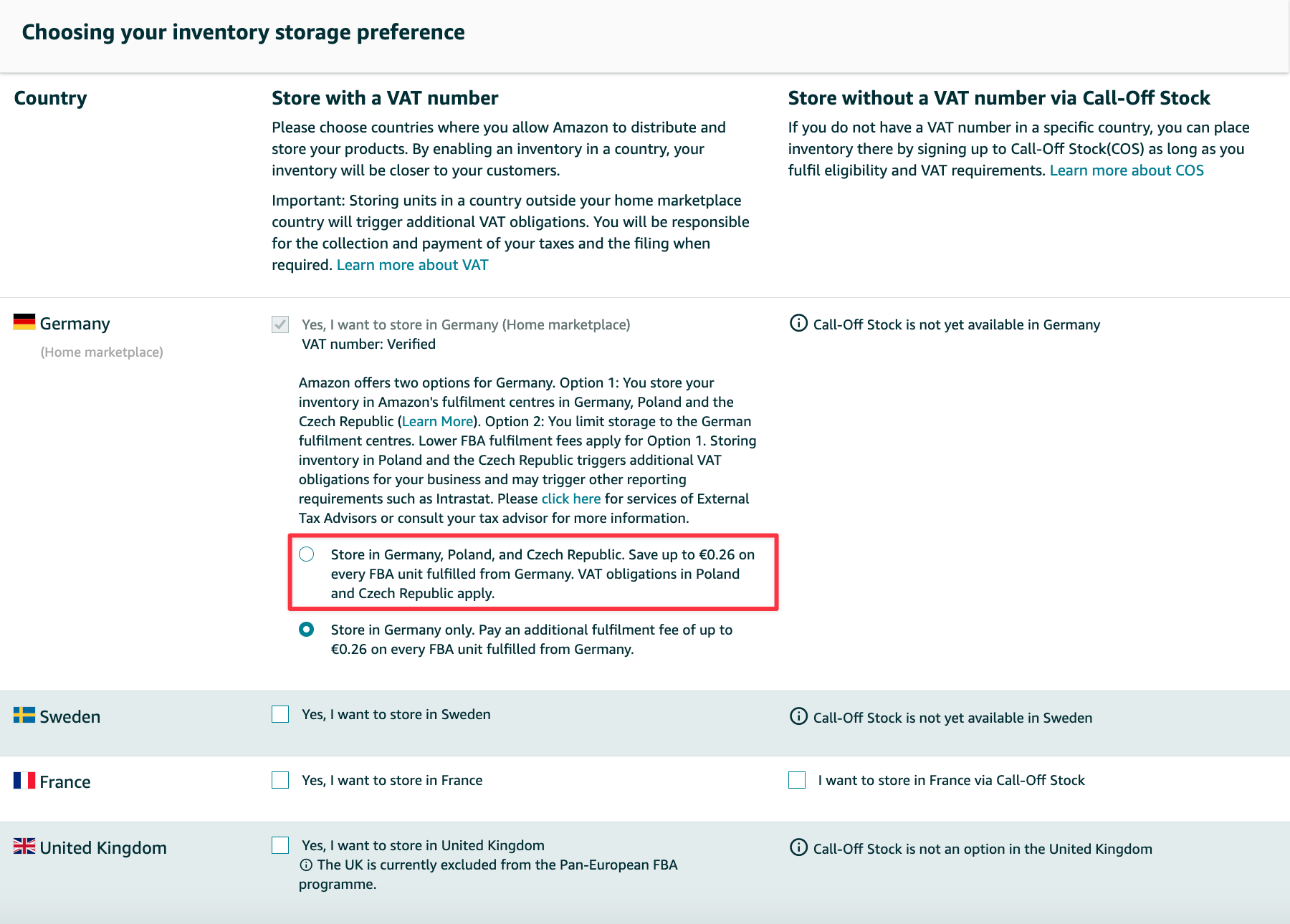

To activate the program, navigate to the "Settings" tab and select "Fulfillment by Amazon." At the top of the page, you'll find the "Cross-Border Fulfillment Settings" section. Click on "Edit" next to it to access this view:

Under the "Choosing your inventory storage preference" section, choose "Store in Germany, Poland, and the Czech Republic." Finally, click "Update" to save your settings.

Conclusion

The Central Europe Programme can be seen as an extension of the European shipping network, as it allows you to store your goods not only in the German logistics center but also in Poland and the Czech Republic. By utilizing this program, you can take advantage of cost-effective shipping rates, saving you the penalty fee of 0.25 Euros. However, it's important to note that storing inventory in additional EU countries comes with certain value-added tax obligations.